Among harmful effects-or top gurus-to become and you may life style debt-100 % free is you at some point provides a credit rating from no. In the event that’s you, done well! You may be unscorable, and since you may be invisible in order to borrowing from the bank sharks and you may credit bureaus, your face a new difficulties: How can you persuade a home loan company you’re a reputable debtor without a credit history?

It’s going to take a bit more performs-but don’t disheartenment. You can buy a home loan in the place of a credit score. Its entirely worth every penny. And you may we will direct you exactly how.

Whilst getting a home loan versus a credit score requires way more files, it is not hopeless. You simply need to select an excellent zero borrowing from the bank lending company that is prepared to take action titled guidelines underwriting-for example our very own family members at Churchill Financial.

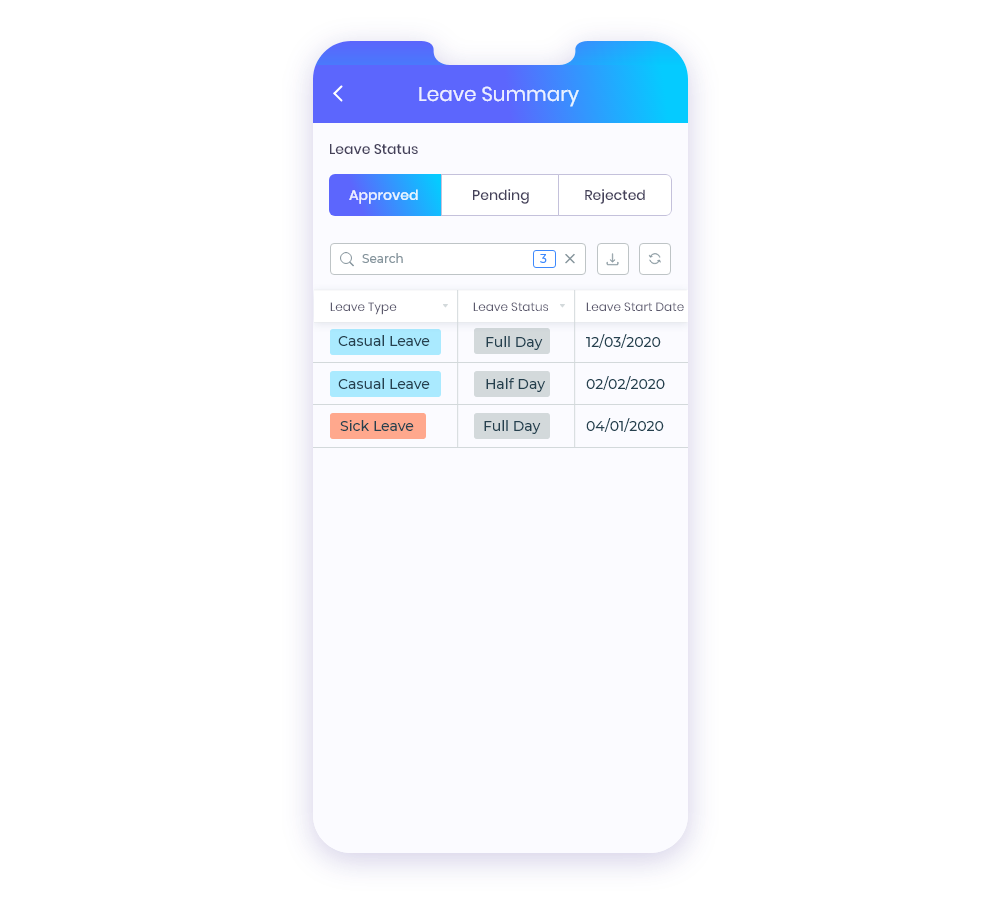

Tips guide underwriting is a hands-towards the study into your capability to pay back loans. Anyway, you will be about to accept home financing, as well as your financial would like to know you might handle it.

step 1. Render proof of payments.

The initial hoop will be documentation-thousands of papers. You will have to inform you verification of your income during the last 12a couple of years, and a steady commission record for at least four normal month-to-month expenses. These types of expenditures range from:

- Lease

- Electric bills perhaps not included in your lease repayments

- Cellular telephone, mobile or cable expenses

- Insurance premium money

- Childcare otherwise college or university tuition payments

The greater evidence you might provide of your own towards the-day payment background, the better your chances of being qualified to suit your mortgage.

Generally speaking, we advice a down-payment of at least 1020% of the house price. But if you do not have credit rating, try using 20% or maybe more because reduces the lender’s risk and you can shows the capacity to deal with money sensibly.

3. Prefer a beneficial fifteen-season fixed-rates old-fashioned financial.

No FHAs. Zero subprimes. Nothing but a ol’ 15-seasons fixed-price old-fashioned home loan. And make certain their monthly home loan repayments are not any over 25% of month-to-month take-domestic spend-and additionally dominant, desire, possessions fees, homeowners insurance, personal financial insurance policies (PMI) please remember to adopt homeowners connection (HOA) costs. That can prevent you from are household poor! This is actually the only financial i ever before highly recommend in the Ramsey due to the fact it has got the general reasonable total price.

What is a credit rating?

A credit score are an excellent three-hand number you to definitely strategies how good you pay back financial obligation. Simply speaking, a credit history is actually an « I like debt » rating. They states you have got obligations in the past, and you may you’ve been immense, moderate or dreadful on purchasing they right back.

Three significant credit reporting agencies-TransUnion, Experian and you will Equifax-explore borrowing-rating designs, like VantageScore and you may FICO, in order to create a rating one to range out of three hundred850.

But faith all of us on this subject-a credit rating is not evidence of effective financially. Sure, you are able to satisfy a lot of people who brag regarding their credit score including it is some type of get a hold of-right up range (« with the FICO measure, I’m an enthusiastic 850 »). Don’t let yourself be conned. A credit score cannot size your riches, money otherwise employment standing-it measures the debt.

What is the Difference in Zero Borrowing from the bank and you may Low Borrowing from the bank?

- Zero credit history: This means you’ve stopped loans. I celebrate so it at the Ramsey since personal debt is actually dumb. If you’ve attained no credit rating, great job! Please remember, you could potentially still purchase a house with no credit rating in the event the your focus on a lender who instructions underwriting.

- Low borrowing from the bank (bad credit): It means you’ve probably generated cash mistakes in earlier times: You filed bankruptcy, defaulted on the property, otherwise racked right up a huge amount of credit debt which you have not been in a position to pay. A low credit score will make it more challenging on the best way to see a lender that is prepared to leave you a mortgage.

When you have a low credit rating, pay-off all personal debt, usually do not miss any expense, and hold back until your credit score disappears before trying to invest in a house. It would be easier for you to get a home loan with zero credit score than simply a low you to definitely-believe united states.

Most other Mortgage Options for Zero Borrowing from the bank otherwise Lowest Borrowing

When you yourself have no borrowing or less than excellent borrowing, lenders will often are speaking you with the a keen FHA financing. But don’t be seduced by they. An FHA mortgage are an entire tear-off-it’s even more expensive than simply a normal home loan.

FHA finance was designed by the us government while making to get an effective domestic easier for basic-time homebuyers otherwise people that cannot with ease be eligible for an effective old-fashioned home loan.

The latest certification on an FHA loan try lowest-thus low, in reality, that should you do not have credit rating (otherwise a decreased credit history) as well as least a good step three.5% down-payment, you’ll almost certainly qualify.

On the surface, FHA loans appear simple. Just what might be completely wrong which have a loan program designed to let first-go out homebuyers pick property? But according to the reasonable-entry requirements is actually a loan you to plenty you up with huge appeal charges and additional financial insurance policies repayments which make you pay higher long-name can cost you.

Work on a beneficial RamseyTrusted Mortgage lender

When you yourself have no credit score plus don’t want any trouble whilst payday loan Glastonbury Center getting a mortgage, manage the household members within Churchill Financial that are masters at undertaking guidelines underwriting. Churchill Financial is full of RamseyTrusted mortgage specialists whom indeed trust in assisting you accomplish personal debt-100 % free homeownership.

Ramsey Solutions could have been dedicated to permitting somebody regain command over their money, build money, expand its leadership event, and you can boost their lifestyle owing to personal advancement since 1992. Lots of people used our economic recommendations due to 22 guides (along with a dozen federal bestsellers) written by Ramsey Push, along with a few syndicated radio shows and you may 10 podcasts, having more than 17 mil each week listeners. Discover more.